What Should You Know Before Getting Online Personal Loans

A personal loan can be a great way to get the money you need quickly. Be sure to research your options and compare rates to find the best deal.- Published by Kunal Chowdhury on .

A personal loan can be a great way to get the money you need quickly. Be sure to research your options and compare rates to find the best deal.- Published by Kunal Chowdhury on .

If you're in the market for a personal loan, you may be wondering if online loans are right for you. There are many online lenders that offer competitive rates and quick turnaround times, making them an attractive option for borrowers looking for a fast loan.

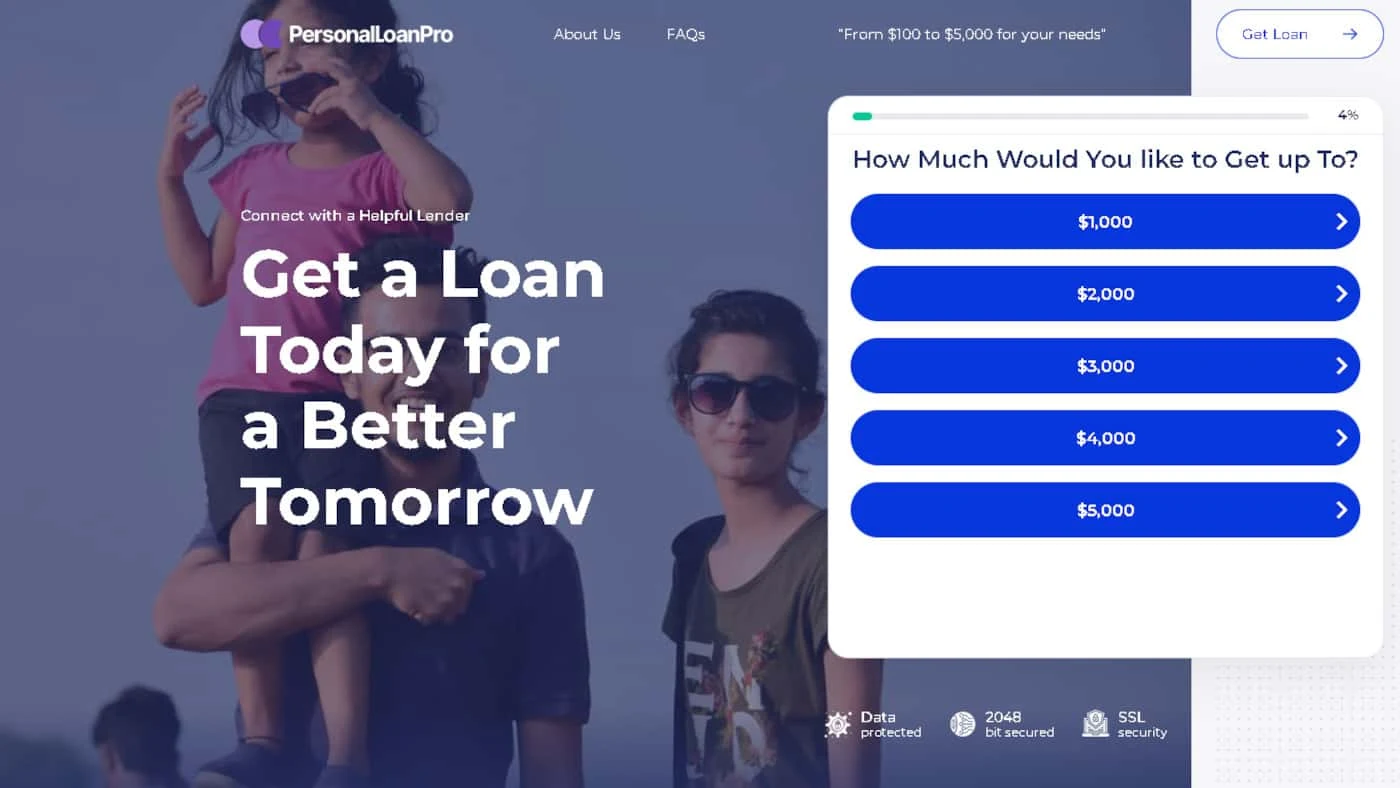

Additionally the online loan brokers have made the online loan process easy, fast, and more efficient. You can go to PersonalLoanPro official website or any other reliable platform to find the best online personal loan deal for you.

But before you apply for an online personal loan, there are a few things you should know. Here are four things to consider before getting a loan from an online lender.

1. Rates and Fees

Like any other type of loan, online personal loans come with interest rates and fees. Make sure you understand the APR (annual percentage rate) and any other fees associated with the loan before you apply.

2. Loan Terms

Be sure to read the loan terms before signing up for a loan. Some online lenders offer terms as short as 12 months, while others may have terms up to five years. Be sure the loan term works with your budget and repayment plan.

3. Eligibility Requirements

Each online lender has different eligibility requirements, so be sure to check the requirements before applying. Generally, you'll need to be a U.S. citizen or permanent resident, have a valid Social Security number, and have a steady source of income.

4. Quick Approval

One of the biggest benefits of getting a loan from an online lender is the quick approval process. Many online lenders can approve loans within minutes, so you can get the money you need fast.

Before applying for an online personal loan, be sure to do your research and understand the terms and eligibility requirements. By understanding what to expect, you can make an informed decision about whether an online loan is right for you.

There are a variety of different types of online personal loans available, and it can be confusing to know which one is right for you. Just click to check online personal loans at the Personal Loan Pro website. It's important to understand the different types of loans available and how they work before you decide which one is best for you.

The most common type of personal loan is a fixed-rate loan. With this type of loan, the interest rate and monthly payment stay the same for the entire term of the loan. This can be a helpful option if you know you'll have the same income for the entire term of the loan.

Another common type of personal loan is a variable-rate loan. With this type of loan, the interest rate can change at any time, depending on the market conditions. This can be a risky option if you're wondering how long you'll need to borrow the money.

There are also a variety of different online personal loans available, such as secured and unsecured loans. A secured loan is backed by collateral, such as your home or car. This can be helpful if you need a large loan and have assets to back it up. An unsecured loan is not backed by any collateral and is a riskier option.

It's important to understand the different types of online personal loans available before you decide which one is right for you. By using Personal Loan Pro you can compare your options, can find the best loan for your needs.

If you are in need of a loan but do not have the time to go through a traditional bank, you may want to consider looking into online personal loans. These loans can be a great option for those who need money quickly and do not have the time or resources to go through a bank.

However, there are some things you should know before you apply for an online personal loan.

The first thing to keep in mind is that not everyone is eligible for an online personal loan. You will likely need good or excellent credit in order to qualify. This is because online personal loans are typically unsecured, meaning they are not backed by any collateral. So, if you have a low credit score, you may not be able to get a loan from a traditional lender.

However, there are still some options available to you. There are a number of online lenders who will offer loans to those with bad credit as you can find with the help of Personal Loan Pro. These loans may come with higher interest rates and terms that are not as favorable, but they can still be a helpful option in a financial emergency.

So, if you are in need of a loan and do not have good credit, be sure to research your options. There are a number of lenders who are willing to work with those who have less-than-perfect credit. And, if you do have good credit, be sure to compare interest rates and terms from different lenders to find the best deal.

When you need money fast, a personal loan may be a good option. But how much can you actually get from a personal loan?

One factor that will affect the amount you can borrow is your credit score. The higher your score, the more money you may be able to borrow. Your income and debt levels will also be taken into account.

Generally, you can borrow anywhere from $1,000 to $35,000 with a personal loan. The amount you can borrow will also depend on the loan term, which can be anywhere from one to seven years.

Be sure to compare rates and terms from different lenders to find the best deal. A high-interest rate can quickly add up, so it's important to find a loan that is affordable.

A personal loan can be a great way to get the money you need quickly. Be sure to research your options and compare rates to find the best deal.

Thank you for visiting our website!

We value your engagement and would love to hear your thoughts. Don't forget to leave a comment below to share your feedback, opinions, or questions.

We believe in fostering an interactive and inclusive community, and your comments play a crucial role in creating that environment.